How to Pay for College [Infographic]

According to a 2019 survey conducted by The Princeton Review, 42 percent of prospective college students and their parents report that debt is their biggest concern when it comes to higher education. This has remained the top concern among college applicants and their families since 2013 — previously, top concerns included admittance to first-choice schools and the inability to pay for these more expensive institutions.

Despite the financial challenges of paying for school, getting a college education remains a key factor in finding a job and staying competitive in the workforce. According to a Pew Research Center survey, employment is rising twice as fast in occupations requiring higher levels of preparation, and some 54 percent of working adults say that further training and development of new skills will be essential for keeping up with changes in the workplace.

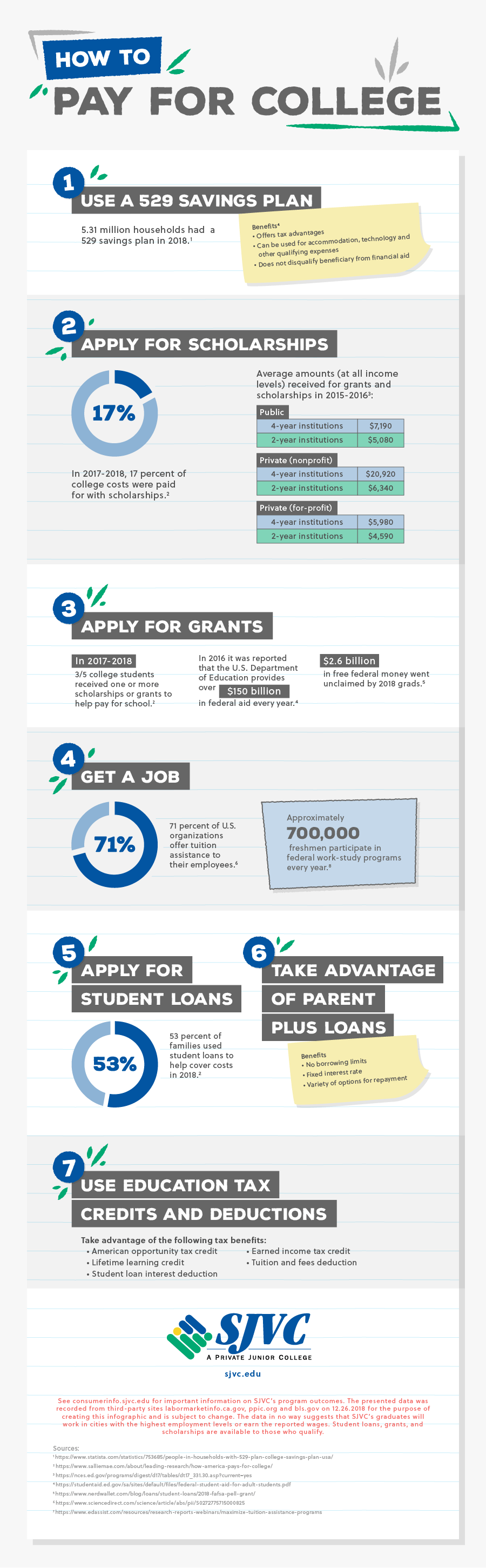

Paying for college can be a challenge, but the benefits of higher education may be worth the additional expense. There are plenty of ways prospective college students can fund their college education, and not all of them translate to student debt down the line. The infographic below highlights some of the ways you can pay for college while taking steps toward a fulfilling career.

At San Joaquin Valley College, our programs are designed to prepare you for in-demand roles in a number of growing fields. Request more information or call toll-free (888) 918-5287 to discover how SJVC can help you take the next step toward your career goals.

More stories about

Request Information

All fields using an asterik (*) are required.